Podiatrist and Medicare Claim Billing with 837 claims

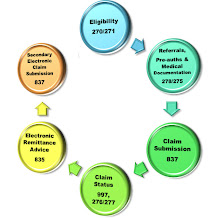

Medicare is identifying that Podiatrists are having issues submitting clean claims using the ANSI 837 file format. If you are billing for a podiatrist that performs routine foot care services, and you are identifying lack of payment on Medicare claims please follow these suggestions:

1. Enter "Date Last Seen (DLS)" in Loop 2300 with the DTP segment and 304 Qualifier

- DLS is the most current date the patient was seen by the attending physician for the services rendered and is required on the claim

Example: DTP*304*D8*20080922~

- Date/Time Qualifier 304 must be included on the claim (used to convey dates associated with the information contained in the corresponding EB Loop)

2. Enter supervising/attending NPI in Loop 2310E, NM109 segment with a DQ indicator. XX will be in segment NM108.

- Supervising Providers Name must be submitted on the claim

- Entity Identifier Code must be DQ

- Supervising Provider UPIN must be submitted

Another note: If you received payment on claims submitted incorrectly (i.e. not billing this information in this format) Medicare is requesting that you refund all payments made and have the claims reprocessed under the correct format.

Learn more about Electronic Medical Billing and Coding at this site medical billings and health insurance claims

Key Words: Podiatrist, Podiatry, Foot Care Medicare Billing, Routine Foot Care Claim, How to bill for Podiatry with Medicare, DQ modifier, Medicare claim billing, Medicare exclusions, resolutions, How to bill, How to fix, Rebill, Refund, Reprocess, Appeal, How to receive insurance payments from Medicare for Podiatry billing, Podiatry claim billing Medicare, Billing Podiatry Claims Electronically for Medicare, medical coding and billing schools, medical billing schools online, medical coding and billing schools online, medical billing classes online, online medical billing school, medical billing and coding courses online, courses online,

If an office bills out 100,000 dollars over 4 months and the billed amounts are 35% over regional medicare reimbursement rates, then how much money should the physician expect to reconcile? Assume 4 months from today or the date of assessment and for simplicity assume that each month was a 25k month.

ReplyDeleteEach month the office is billing $25,000.00 and you want to know on average what you will be collecting.

ReplyDeleteMost offices aim for 50% collection rate or $12,500.00. I wasn't supplied with procedure codes, specialty or the mix of health insurance carriers you are billing too so this equasion is nearly impossible to identify.

Most offices that I consult with charge 150% higher than Medicare allowable. If you would like more specific details I would need some additional information like:

1. What is the doctors specialty

2. How many of the claims are billed to Medicare?

3. What other insurance carriers do you bill to?

4. What are their allowed amounts per procedure code?

5. Top 10 procedure codes you bill with.

I always recommend charging 10% higher per procedure code on the insurance carrier that pays you the most for that procedure code.

Example:

BCBS will pay Doctor A $95.00 on a procedure

Aetna will pay Doctor A $75.00 on same procedure

UHC will pay $101.00 on same procedure

Medicare will pay $62.00 on same procedure

Take UHC's allowable and times by .10% and that should be your charge for the procedure.

Each procedure code may get paid higher by a different insurance carrier. Your contractual adjustments will be high but this will ensure you get paid every 100% allowed for your charge.

Let me know if I can help you with anything else.

Jennifer

Ask A Medical Biller

http://www.askamedicalbiller.blogspot.com/

Hi there, awesome site. I thought the topics you posted on were very interesting. I tried to add your RSS to my feed reader and it a few. take a look at it, hopefully I can add you and follow.

ReplyDeleteInteresting blog. It would be great if you can provide more details about it. Thanks you.

ReplyDeletePodiatry